new mexico pension taxes

Known as U1 U2 and U4 through U6 U3 is the official unemployment rate these alternative measures of labor underutilization provide insight into a broad range of problems workers encounter in todays labor market. The Government Pension Fund Global also known as the Oil Fund was established in 1990 to invest the surplus revenues of the Norwegian petroleum sectorIt has over US119 trillion in assets and holds.

Cash Strapped New Mexico Missed 193m In Insurance Taxes

NW IR-6526 Washington DC 20224.

. Taxpayers 65 years of age or older may be eligible for an income tax deduction of up to 8000 depending on income level. Public Pension Reserve Funds Statistics. This represented a major change in New Zealand taxation policy as until this point almost all revenue had been raised via direct taxes.

Government deficitsurplus revenue expenditure and. The Crown and the Viceroyalty of New Spain. Theyre due on the next business day if April 15 falls on a weekend or holiday.

We welcome your comments about this publication and suggestions for future editions. Get the latest international news and world events from Asia Europe the Middle East and more. 20 of your Federal Earned Income Tax Credit military pension income and certain retirement.

Residents who are at least 100 years of age and who are not. New Jersey Division of Taxation. Get the right guidance with an attorney by your side.

Formally a string is a finite ordered sequence of characters such as letters digits or spaces. Comments and suggestions. New Mexico taxes Social Security benefits pensions and retirement accounts.

The Government Pension Fund of Norway Norwegian. The empty string is the special case where the sequence has length zero so there are no symbols in the string. Are calculated based on tax rates that range from 10 to 37.

The Bureau of Labor Statistics BLS publishes a range of indicators that point to the extent to which labor resources are being utilized. A pension may be a defined benefit plan where a fixed sum is paid regularly to a person or a defined contribution plan. GST makes up 24 of the New Zealand Governments core revenue as of 2013.

The Kingdom of New Spain was established on August 18 1521 following the Spanish conquest of the Aztec Empire as a New World kingdom ruled by the Crown of CastileThe initial funds for exploration came from Queen Isabella. Income taxes in the US. New Jersey divorce law doesnt need to be a mystery.

Follows federal tax rules. You can pay your taxes by making electronic payments online. Although New Spain was a dependency of Castile it was a kingdom and not a colony subject to the.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits. Government expenditure by function COFOG 12.

In the case of Belgium the new protocol entered into force in general as of 1 January 2018. Click on Wheres My Refund at the left side of the page. Get the latest science news and technology news read tech reviews and more at ABC News.

A pension ˈ p ɛ n ʃ ə n from Latin pensiō payment is a fund into which a sum of money is added during an employees employment years and from which payments are drawn to support the persons retirement from work in the form of periodic payments. Watch CBS News live and get the latest breaking news headlines of the day for national news and world news today. 551 Basis of Assets.

Our network attorneys have an average customer rating of 48 out of 5 stars. Thats the case in 2022 when the deadline is extended to. Distribution of graduates and new entrants by field.

California Idaho Louisiana Nevada New Mexico Texas Washington and Wisconsin. Federal income taxes are typically due on April 15. If you and.

Goods and services tax GST is an indirect tax introduced in New Zealand in 1986. From a mobile device using the IRS2Go app. If retirement income exceeds the deduction.

The 10 rate applies on the gross amount of. Or in cash or by check or money order. Taxes and social contributions receipts.

Click on the Check Refund Status box. Discover residency requirements grounds for dissolution and what to expect regarding property May 02 2022 6 min read. News from San Diegos North County covering Oceanside Escondido Encinitas Vista San Marcos Solana Beach Del Mar and Fallbrook.

The exemption can be applied to all retirement income including Social Security benefits pension income and retirement account income. The Jerusalem Post Customer Service Center can be contacted with any questions or requests. Statens pensjonsfond comprises two entirely separate sovereign wealth funds owned by the government of Norway.

New Mexico taxes all forms of retirement income including Social Security while offering a deduction to seniors with household income below a certain limit. A financial advisor can help you understand how taxes fit. 2421 Extension 4 Jerusalem Post or 03-7619056 Fax.

The 49 rate applies on the gross amount of the interest paid to banks and pension funds or pension schemes. The New Jersey income tax has seven tax brackets with a maximum marginal income tax of 1075 as of 2022. Pension and Annuity Income.

Montana taxes all pension. In 2022 up to 10000 of military retirement is tax-free. And while we can provide a good estimate of your Federal and New Jersey income taxes your actual tax liability may be different.

Retirement Security Think New Mexico

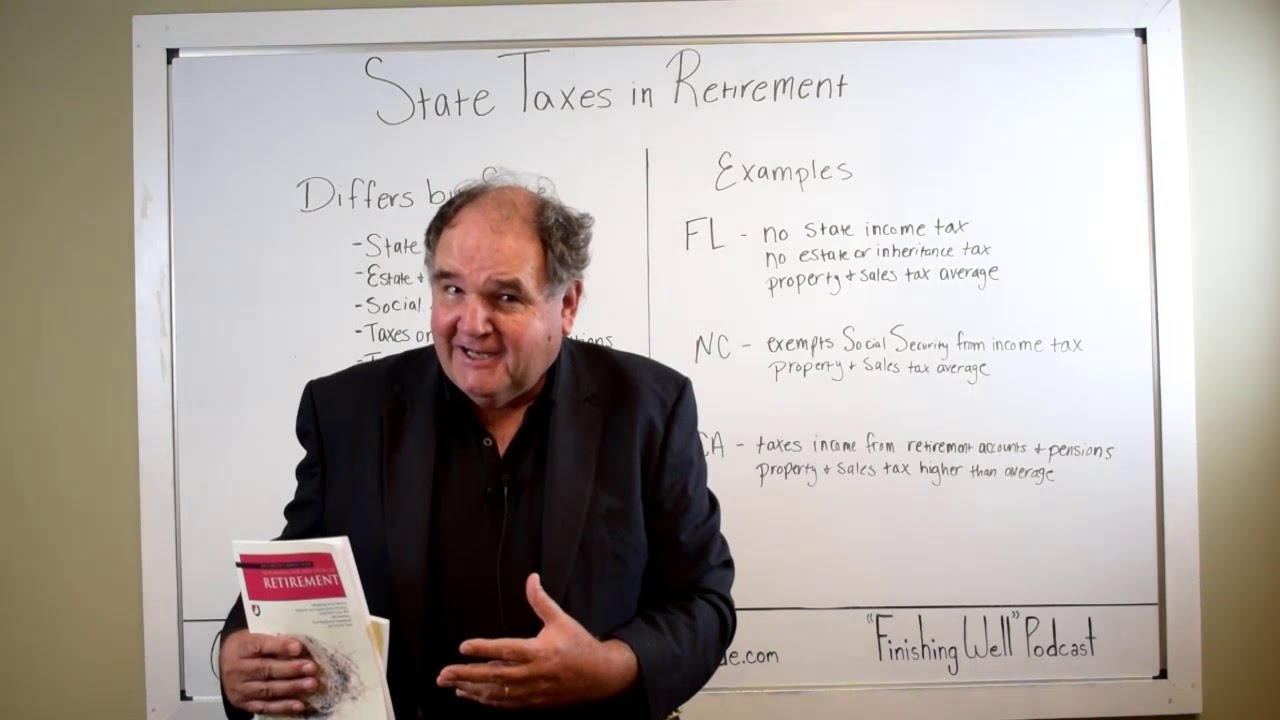

How Every State Taxes Differently In Retirement Cardinal Guide

Taxes And Social Security In 2020 Everything You Need To Know Simplywise

New Mexico Retirement Tax Friendliness Smartasset

6 Pros And Cons Of Retiring In New Mexico 2020 Aging Greatly

How Is New Mexico For Retirement

States That Won T Tax Your Federal Retirement Income Government Executive

New Mexico Retirement Taxes And Economic Factors To Consider

The 10 Best Places To Retire In New Mexico In 2022 Personal Capital

Retiring These States Won T Tax Your Distributions

New Mexico Retirement Tax Friendliness Smartasset

Tax Withholding For Pensions And Social Security Sensible Money

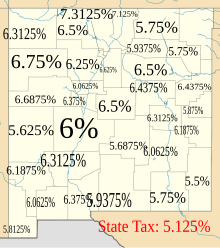

Taxation In New Mexico Wikipedia

New Mexico Retirement Guide New Mexico Best Places To Retire Top Retirements

Tax Withholding For Pensions And Social Security Sensible Money

:max_bytes(150000):strip_icc()/5ToolsforRetirementPlanning-3954dc7e62a04daea0c47422dd74d33d.jpg)

State Income Tax Breaks For Retirees

Historical New Mexico Tax Policy Information Ballotpedia

Social Security Benefits What Are The Best States To Retire For Taxes Marca

Legislature 2018 More Money Brighter Outlook Albuquerque Journal